Our CEO’s own (not so) super story

Just as doctors’ kids tend to be sick and plumbers’ homes have dripping taps, ‘money people’ don’t always do what they should either. That was certainly true for me when it came to my super. This is my shameful story.

I’m in my 33rd year of making money and paying tax. Most of my early jobs were in hospitality, first alongside study and then as a pathway to move from South Australia to Sydney, via Japan and Europe. As an aside, the people who told me I would get sick of pizza, doughnuts and wine were SO wrong, but that’s a story for another day. Then after seven years working at American Express, I started my first small business. I was terrible at paying myself and even worse at paying my super. Next came full time motherhood, a separation, and more jobs.

The result? Not enough super, and way too many super accounts. I cringe even thinking about it.

I eventually convinced myself that I had it sorted. You know, the type of conversation you have with yourself about your jeans being too tight because of the dryer, not the solo midnight wine and cheese parties you’ve been hosting too regularly? But I was kidding myself. I was also guilty of leaving it to my husband to sort out. And just in case you’re wondering, that’s a big NO-NO. Do what I say, not what I did!

My husband and I have complex financial affairs – and the industry expertise to manage them – so we have an SMSF (self-managed super fund). I had just assumed that all my super was in there. Well, was I wrong!

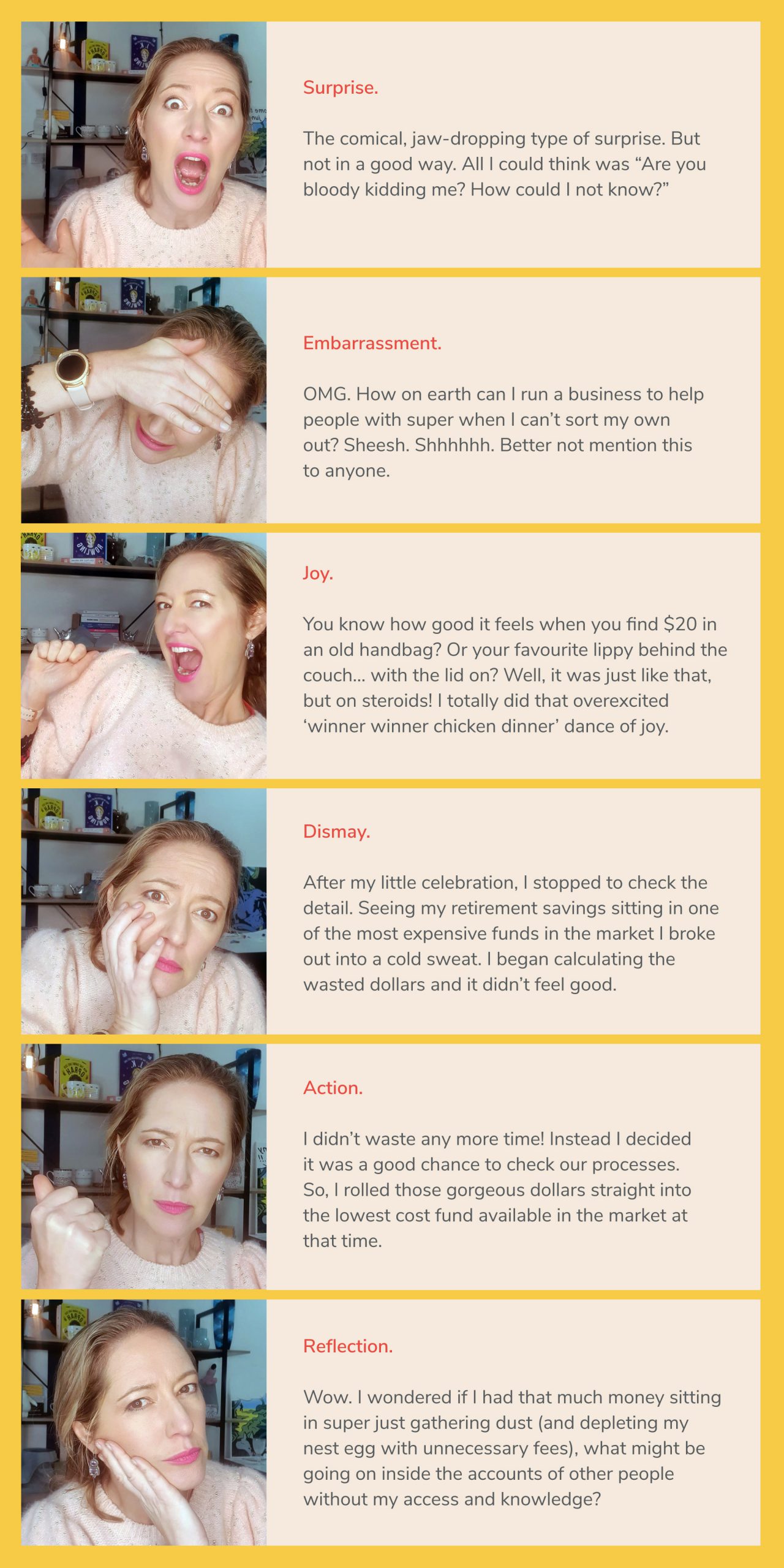

When I started building Super Fierce, I decided to use my personal info to head into the ATO website to check out how certain things work. Imagine my surprise when I found a 6-figure number sitting in an account! The range of emotions?

Ever since that moment, I’ve been working like crazy to translate my learnings into a beautiful digital super comparison tool which will make it simple for Aussies to:

1. Find their super.

2. See how much they have and how much they’re paying in fees.

3. Project how much they’re on track to retire with if they make no change.

4. See if they can retire with more by saving on super fees.

5. Make a change if they’d like to.

Twelve months on I have learnt a lot!

Lesson 1: Building a female-focused FinTech is much harder and more time consuming than I thought.

Now, I probably should have realised it was a huge undertaking to … build a complicated algorithm with multiple databases, code it and integrate multiple tech feeds … get an Australian Financial Services Licence … create a brand, work out how to make something complex easy to understand and build a website … form a team … fund it with blood, sweat, tears and my life savings … it goes on. But thank goodness I didn’t know, or Super Fierce might have remained just a dream.

Lesson 2: Linking purpose, passion and heart is an unbeatable formula.

Inside my head is a very loud voice which keeps reminding me that I am able to help. To really make a difference to people’s lives. It urges me to think about what an extra $100,000 at retirement would mean for women who’ve worked hard their entire lives but earned 17% less just because of their gender.

That makes it more than worth it to me. Even when I feel guilty about not spending enough time with my kids. Or when my friends wish I’d make time to return their calls (sorry guys! I do love you). Or my husband wonders if I am ever coming to bed. Because we have enough. And we need to do more.

Lesson 3: Global Pandemics have taught me that “I eat scared for breakfast.” Most of the time.

Trying to finish a product and launch a business when your team is scattered far, people are struggling through financial stress and isolation, and the world has basically been turned upside down, isn’t ideal. But I have discovered we are capable of so much more than we know. And I whisper to myself wise Wednesday Addam’s words each morning when I rise: “I eat scared for breakfast.”

Oh! And I’m still celebrating my super windfall – which has been happily growing over the last 12 months – and all the dollars that I’m no longer wasting on fees.

General information only

Finance topics we discuss in our videos, on our website and in other marketing material is general in nature. It doesn’t take into account your personal circumstances, your financial situation or your specific needs. You should consider seeking independent legal, financial, taxation or other advice to check how this information relates to your unique circumstances.

Super Fierce Pty Ltd (ABN 22 632 423 575) is the holder of Australian Financial Services Licence (AFSL no. 534567).

I was terrible at paying myself and even worse at paying my super. Next came full time motherhood, a separation, and more jobs.

I have discovered we are capable of so much more than we know. And I whisper to myself wise Wednesday Addam’s words each morning when I rise: “I eat scared for breakfast.”

You can see how we look after your personal info here.

hello@superfierce.com.au

hello@superfierce.com.au